File Your Truck Tax Form 2290 Online & Get Stamped Schedule 1 Instantly

It’s a Simple, Secure, and Easy HVUT Filing Solution!

- Get your Stamped Schedule 1 in Minutes

- Guaranteed Schedule 1 or your Money Back

- Free VIN Correction

Starts at $14.90 for a single truck.

Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes.

E-file Form 2290 Now

About File Your Truck Tax

FileYourTruckTax takes the hassle out of IRS heavy vehicle use truck taxes by providing premier HVUT Schedule 1 software. Our safe and secure program allows you to easily file so you can receive your form 2290 schedule 1 in minutes! plus, we don’t stop at HVUT truck tax form 2290. With us, you can e-file VIN corrections, e-file IRS form 8849, and even file IRS HVUT form 2290 amendments. everything you need is included in our complete HVUT schedule 1 software.

When is Truck Tax Form 2290 Due?

Form 2290 needs to be filed every year by August 31st for each of the taxable vehicles used on the public highway for the current tax period. The Tax period for Form 2290 starts on July 1 and ends on June 30.

The due date to file Form 2290 will be the last day of the month following the month that the vehicle was first placed on the road.

Note: If any Form 2290 due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

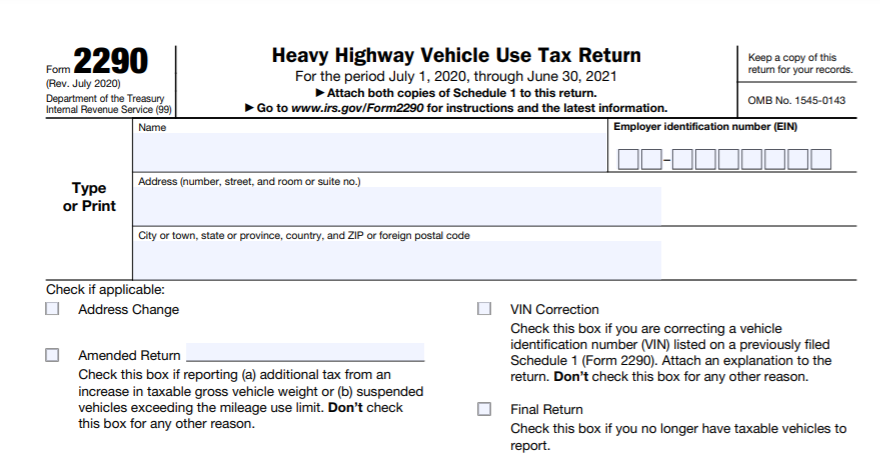

Requirement to File your

Truck Tax

Business Details

- Employer Identification Number (EIN)

- Business Name

- Address

Vehicle Details

- First Used Month (FUM)

- Vehicle Identification Number (VIN)

- Taxable Gross Weight Category

- Suspended Vehicle (if any)

Advantages of Filing Truck Tax with our Software

E-File VIN Corrections

E-File VIN Corrections

If you enter the wrong VIN on IRS HVUT Form 2290, don't worry! You can quickly e-file VIN corrections for free!

Guaranteed Schedule 1 or Your Money back

Guaranteed Schedule 1 or Your Money back

IRS will accept your Form 2290 and You will receive your Stamped Schedule 1 from IRS or Your Money Back

Re-transmit Rejected Return for Free

Re-transmit Rejected Return for Free

If your Form 2290 was Rejected by IRS, You can Re-transmit it to the for Free

Truck Tax Form 2290

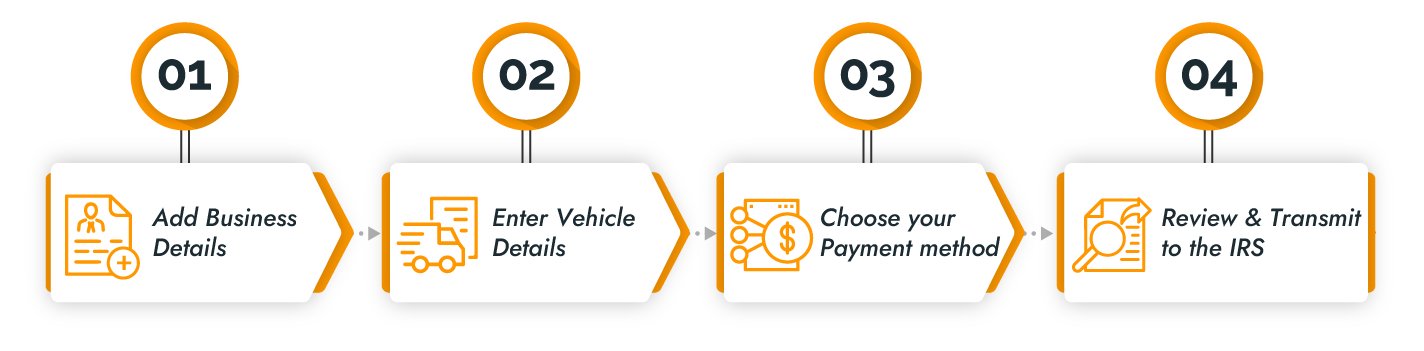

Operators of heavy vehicles weighing 50,000lb or more are required to file IRS form 2290 in order to get a copy of their IRS stamped schedule 1, which serves as proof of their HVUT truck tax payment. The IRS heavy vehicle use tax is due based on your vehicle's first used month during the HVUT truck tax period. By using FileYourTruckTax.com, the user-friendly 2290 e-file software provider you can follow simple steps to complete your IRS HVUT form 2290 in minutes. As a result, you will receive your IRS Stamped Schedule 1 via email. your Form 2290 schedule 1s will be accepted by dmvs and is needed to renew your tags.

2290 Amendments

2290 Amendments

If you need to update your IRS HVUT Form 2290 you can make a form 2290 amendment with our HVUT Schedule 1 software. 2290 amendments are used to report HVUT truck tax changes, like if you have exceeded the suspended vehicle’s gross weight mileage limit. Another amendment example includes if you e-file VIN corrections.

Form 8849

Form 8849

IRS Form 8849 is used when your credit amount exceeds the amount of HVUT truck tax you owe. Examples of IRS HVUT Form 2290 credits include if your vehicle was lost, stolen, or destroyed. As an innovative 2290 e-file software provider if we see your credit amount is greater than the amount of IRS heavy vehicle use tax that you owe, we will automatically generate IRS form 8849

for you.

FAQs

If you need to update your IRS HVUT Form 2290 you can make a form 2290 amendment with our HVUT Schedule 1 software. 2290 amendments are used to report HVUT truck tax changes, like if you have exceeded the suspended vehicle’s gross weight mileage limit. Another amendment example includes if you e-file VIN corrections.

IRS Form 8849 is used when your credit amount exceeds the amount of HVUT truck tax you owe. Examples of IRS HVUT Form 2290 credits include if your vehicle was lost, stolen, or destroyed. As an innovative 2290 e-file software provider if we see your credit amount is greater than the amount of IRS heavy vehicle use tax that you owe, we will automatically generate IRS form 8849 for you.

A highway heavy motor vehicle such as a truck that carries load over public highways with a gross weight of 55,000 pounds or more is considered a taxable vehicle.

Every owner of a highway motor vehicle that weighs more than 55,000 pounds must file Form 2290 every year. However, if that vehicle is not driven more than 5,000 miles (7,500 for agricultural vehicles), HVUT payment is not required

Heavy vehicle use taxes are calculated based on your vehicle’s weight and duration of use during each tax year. For instance, if you start using a truck with a gross taxable weight of 55,001-56,000 pounds in January, your tax payment for 2023-2024 will only be $122. However, if you are renewing your HVUT in August for a truck weighing over 75,000 pounds, your tax payment will be $550 (the maximum HVUT amount).